Introducing Productboard Pulse. Exec-level insights into what your customers need, powered by AI.

If you’re like most product managers, you probably struggle with deciding what to build next. With so many competing priorities, it is hard to figure out what features and product initiatives to prioritize.

Getting to product/market fit is the first step on a path that can build traction for your startup.

Product/market fit is a common concept in the product management world. Marc Andreessen, the legendary Silicon Valley entrepreneur, co-founder of the VC firm Andreessen Horowitz and creator of the once-dominant web browser Netscape, is often associated with popularizing the term. In his blog post, “The only thing that matters,” Andreessen describes product/market fit as the moment when a startup successfully finds a set of customers to serve with their product:

“Product/market fit means being in a good market with a product that can satisfy that market.”

Whenever you see a successful startup, you see one that has achieved product/market fit. You can always feel that product/market fit is happening—it leaves no room for doubt.

In his book The Lean Startup, Eric Ries helps us picture what product/market fit looks like:

“When you see a startup that has found a fit with a large market, it’s exhilarating. It is Ford’s Model T flying out of the factory as fast as it could be made, Facebook sweeping college campuses practically overnight, or Lotus taking the business world by storm, selling $54 million worth of Lotus 1-2-3 in its first year of operation”

To better understand what product/market fit is, we’re going to explore how other influential figures in the startup world describe this idea. Here are their definitions of product/market fit, which we will break down in further detail below:

Andy Rachleff, the co-founder of investment firm Wealthfront and Benchmark Capital, first developed the idea of product/market fit:

“When you first start out, the only thing that matters is finding a cohort of customers who truly value what you offer. Growth alone means next to nothing.”

Rachleff believes that startups should determine and test their value hypothesis before they move on to their growth hypothesis.

A value hypothesis answers why a customer is going to use your product:

“A value hypothesis is an attempt to articulate the key assumption that underlies why a customer is likely to use your product. Identifying a compelling value hypothesis is what I call finding product/market fit. A value hypothesis addresses both the features and business model required to entice a customer to buy your product.”

A growth hypothesis is how you’re going to scale your customer base:

“A growth hypothesis represents your best thinking about how you can scale the number of customers attracted to your product or service.”

Rachleff recommends that startups need to validate their value hypothesis before they scale:

“After all, if the dogs don’t want to eat the dog food, then what good is attracting a lot of dogs?”

Paul Graham, co-founder and partner at Y-combinator, describes product/market fit as making something that people want.

“Why do so many founders build things no one wants? Because they begin by trying to think of startup ideas. That m.o. is doubly dangerous: it doesn’t merely yield few good ideas; it yields bad ideas that sound plausible enough to fool you into working on them.”

According to Graham, when a startup launches, there should be some people who need the product, not just see the potential benefit of using it. You need users that want to use your product or feature urgently.

When evaluating product/market fit, ask yourself: who wants this right now? Who wants what you’re building so much that they’ll use it even when it’s a scrappy first version with lots of bugs.

In the words of Graham, successful startups are born by identifying startup ideas, not coming up with them:

“The verb you want to be using with respect to startup ideas is not ‘think up’ but ‘notice.’ At YC we call ideas that grow naturally out of the founders’ own experiences “organic” startup ideas. The most successful startups almost all begin this way.”

For many entrepreneurs, Graham’s words imply that you achieve product/market fit organically by identifying needs in the market, instead of by forcing your perspective on users.

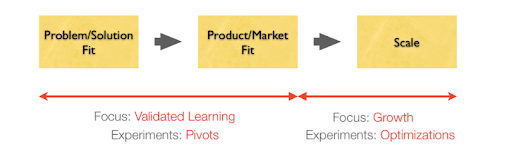

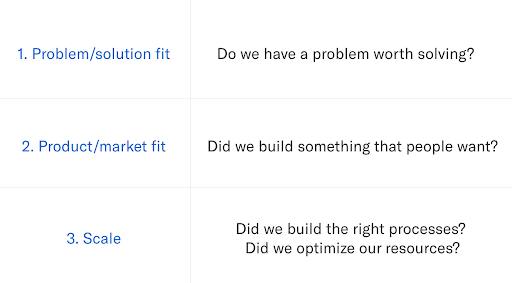

Ash Maurya, author of “Running Lean” and creator of the LeanStack, breaks the startup lifecycle into three stages:

Stage 1: Problem/Solution

This stage is about validating the problem/solution fit. The critical question to ask yourself in this stage is: Do we have a problem worth solving?

Answer this by separating the problem from the solution and testing just the problem via customer development interviews. The goal of this stage is to identify if there’s a problem worth solving before building out a solution.

Stage 2: Product/Market fit

Once you have a problem worth solving, you can start evaluating how well your solution (i.e., your product) solves that problem.

The key question during this stage is: Have I built something people want?

Startups should focus on validated learning through experiments (Pivots) while they move from the first and third stages.

Stage 3: Scale

Reaching Product/Market Fit is a significant milestone in the life of every startup. The next and last step is the Scale (or growth) stage. During this period, teams start to think about processes and optimization.

The critical question here is: How do we accelerate growth?

The key questions to ask at each stage, according to Maurya:

Sam Altman, CEO of OpenAI and former president of Y Combinator, characterizes product/market fit by having enough users that “love your product so much they spontaneously tell other people to use it.”

Like Rachleff and Maurya, Altman also makes a point that startup teams need to make a product that users really love before they focus on growth:

“A startup that prematurely targets a growth goal often ends up making a nebulous product that some users sort of like and papering over this with ‘growth hacking’. That sort of works—at least, it will fool investors for a while until they start digging into retention numbers—but eventually, the music stops.

The very best technology companies sometimes take a while to figure out exactly what they’re doing, but when they do, they usually pass that binary test before turning all their energy to growth. It’s the critical ingredient for companies that do really well, and if you don’t figure it out, no amount of growth hacking will make you into a great company.”

A similar definition of product/market fit could be found as one of the 13 Principles of Product Design by Joshua Porter, partner at Rocket Insights, and former Director of UX at HubSpot.

Porter’s description of product/market fit shares the same sentiment, suggesting that the level of enthusiasm by users is a leading signal of Product/market fit:

“Product-market fit is a funny term, but here’s a concrete way to think about it. When people understand and use your product enough to recognize it’s value that’s a huge win. But when they begin to share their positive experience with others, when you can replicate the experience with every new user who your existing users tell, then you have product-market fit on your hands. And when this occurs something magical happens. All of a sudden your customers become your salespeople.”

Lean manufacturing has a concept called “pull.” It means that nothing is done in development or delivery until the customer expresses a need or a demand for the product or feature.

According to Patrick Vlaskovits, author of The Lean Entrepreneur and The Entrepreneur’s Guide to Customer Development, product/market fit can be thought of as a massive pull.

A massive market pull has two main attributes:

“Product-market fit can be thought of as a pull on a large scale. So many customers are demanding your product (and product features), that a clear market signal has been sent saying your product is needed.

Product-market fit is a match between product and market segment that results in high growth or high demand. This isn’t an assumption, but rather describes a significant change in the number of customers based on having achieved the fit.” — Patrick Vlaskovits, The Lean Entrepreneur

In his famous post, Marc Andreessen gave us a clear illustration of what product/market fit feels like:

“You can always feel when product/market fit isn’t happening. The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of “blah,” the sales cycle takes too long, and lots of deals never close.

And you can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it.”

Unfortunately, Andreessen ended that essay with more questions than answers and didn’t offer any guidance on how to actually get product/market fit.

In our attempt to make this process more actionable, we’ll share two frameworks for finding product/market fit.

Driven by the responses from the product/market fit survey, Rahul developed a four-step framework to optimize and improve their product/market fit.

The engine consists of the following steps:

1. Segment your supporters and paint a picture of your high-expectation customers

In his book Running Lean, Ash Maurya stresses the importance of segmentation when conducting the Sean Ellis test. He says that “for the results to be statistically significant, you need to have a large enough sample size, account for customer segmentation, and consider user motivation.”

When you’re starting, you may have attracted a ton of unqualified leads and users. These are the type of users that don’t need your product and are most likely to churn before they become active customers.

To narrow the Superhuman audience, Rahul used the “very disappointed” group of survey respondents to create a segment of people that strongly resonate with the product.

Next, they assigned a persona to each person who opted in for the survey.

Side note: this process of tagging ideas and elements with codes and then grouping them into concepts is known as grounded analysis.

As a last step of the segmentation process, Rahul and his team looked at the personas that appeared in the very disappointed group and used those to narrow the market. They ended up focusing on founders, managers, executives, and business development and ignoring all other personas.

With this segmented view of the data, their product/market fit score shifted from 22% to 32%.

To visualize the people that love using Superhuman, Rahul turned to Julie Supan’s high-expectation customer framework. Combining Supan’s framework with the answers to their second question “What type of people do you think would most benefit from Superhuman?” Rahul developed a detailed persona of the Superhuman high-expectation customer (HXC).

With their HXC persona in mind, Superhuman focused the entire company on serving that precise segment of users.

2. Analyze feedback to convert on-the-fence users into fanatics

To steer Superhuman towards product/market fit, Rahul looked at the responses to two more questions from the product/market fit survey:

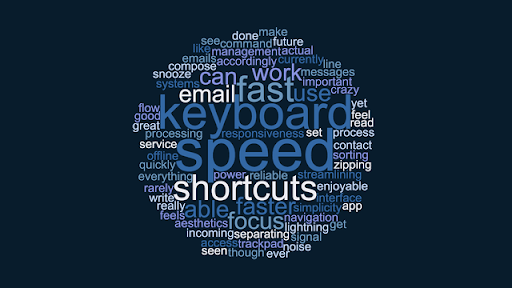

Rahul ignored the answers of participants who would “not be disappointed if they could no longer use the product.” He used a word cloud tool to spot common themes in answers to “What is the main benefit you receive from Superhuman?”

With this deeper understanding of the product benefits, Rahul segmented the data further to analyze only answers from “somewhat disappointed” users—those most likely to convert to supporters.

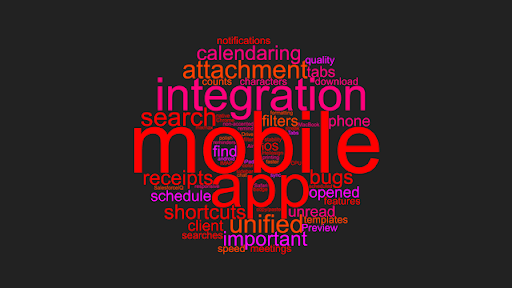

Focusing on this last group, Rahul looked more closely at their answers to the last question: “How can we improve Superhuman for you?”

After some work, Superhuman found that the main feature holding back their users was the lack of a mobile app.

“With a clear understanding of our main benefit and the missing features, all we had to do was funnel these insights back into how we were building Superhuman. Implementing this segmented feedback would help the somewhat disappointed users get off the fence and move into the territory of enthusiastic advocates.”

—Rahul Vohra

3. Build your roadmap by doubling down on what users love and addressing what holds others back

“If you only double down on what users love, your product/market fit score won’t increase. If you only address what holds users back, your competition will likely overtake you.”

Rahul’s team took a balanced approach when shaping their roadmap based on the findings from the survey. They dedicated half the roadmap to doubling down on features that users love, such as speed, more shortcuts, increased automation. They dedicated the rest to pleasing the somewhat-disappointed users, such as mobile app development, new integrations, and calendar features.

To evaluate feature importance, Rahul used a simple prioritization framework based on the cost-impact analysis. They labeled each potential project as low/medium/high cost, and similarly low/medium/high impact.

4. Repeat the process and make the product/market fit score the most important metric

Rahul and his team embraced Product/market fit score (the percentage of people who respond with “very disappointed”) as the most critical metric, constantly surveying people and tracking this number weekly, monthly and quarterly.

By rallying around this metric, they boosted their product/market fit score from 22% (in 2017) to 58%.

In his book, Running Lean, Ash Maurya introduced a process for getting to product-market fit.

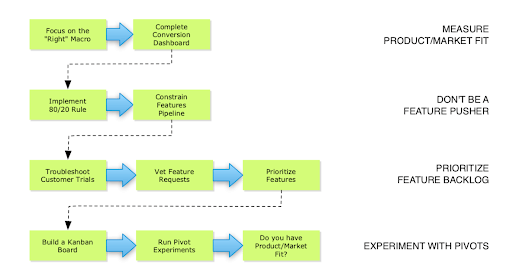

He grouped the process into four overarching categories:

Let’s explore each group and its steps.

Measure product/market fit

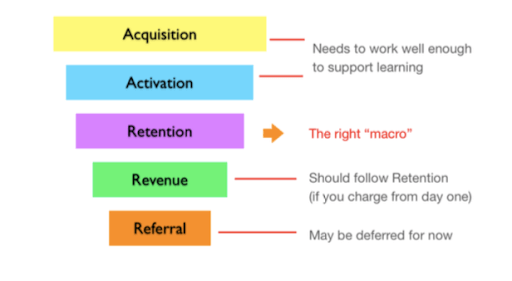

Maurya recommends a simple approach to quantifying product/market fit: measure your retention.

Source: Running Lean

Source: Running Lean

“Of the five startup metrics, the most indicative measure of “building something people want” is Retention i.e., repeated use of your product. Why else would they keep coming back?”

—Ash Maurya, Running Lean

Maurya believes that “you have achieved product/market fit when you are retaining 40% of your activated users month over month.”

Retention measures the repeated activity of an active user over a specific timeframe. Therefore, you’ll need to define what an active user is for your product as there are many ways to do so. The most basic one is by measuring logins (i.e., do the users come back?).

Next, you need to visualize retention in your metrics dashboard. In a perfect case scenario, you’re going to measure the number of active users by cohorts.

Don’t be a feature pusher

As we previously discussed, achieving product/market fit means having a massive pull from the market. In other words, features must be pulled, not pushed.

To prioritize focus, Maurya suggests using the 80/20 rule: “most of your time after launch should be spent measuring and improving existing features versus chasing after new shiny features.”

A good practice for keeping your product development pipeline constrained is limiting the number of features that you can work on at a given time.

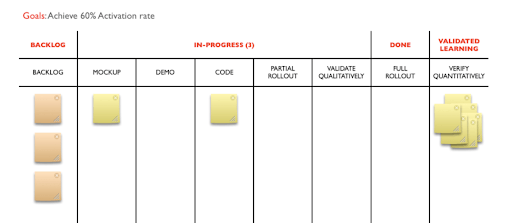

A great way to do that is to use a Kanban product management board with three feature lists:

While this may seem obvious to a seasoned product manager, there’s an important caveat in Maurya’s process. A feature is only “Done” when it provides validated learning from customers.

“Defining “Done” this way further constrains your feature pipeline and prevents you from working on any new features unless you can prove that the current features just deployed provided validated learning.”

—Ash Maurya

Prioritize feature backlog

According to Maurya, troubleshooting users in the trial window is the best way to build up your feature backlog.

“I particularly like trials because they time-box the full user lifecycle and force an outcome which leads to quick actionable learning. The way you troubleshoot your trials is following the path a user takes through your user lifecycle.”

—Ash Maurya

To process new feature requests that come up during the trial period, Maurya uses a Getting Things Done (GTD) type workflow that starts by checking the request against your product’s immediate needs and priorities.

Experiment with pivots

In the last stage of the Running Lean process for achieving product/market fit, Maurya asks us to track the complete feature lifecycle using a Kanban board.

You should validate each feature qualitatively (via usability interviews) and quantitatively. When you set the feature live, compare your conversion cohorts for the week the feature went live against the previous week to verify the expected macro impact.

Quantitative verification can take a while. That’s why in the kanban diagram below, you will notice that a feature is considered “Done” after passing the qualitative validation.

“Startups occasionally ask me to help them evaluate whether they have achieved product/market fit. It’s easy to answer: if you are asking, you’re not there yet.” —Eric Ries, The Lean Startup

You can always “feel” when product/market fit isn’t happening. But companies should usually try and quantify if they’re within reach of it or desperately far away.

Before you can answer if you have found product/market fit, it is essential to understand the common components of product/market fit.

In his book The Entrepreneur’s Guide to Customer Development, Vlaskovits states that product/market fit requires three criteria to be satisfied:

In other words, you haven’t reached product/market fit if:

To help you determine product/market fit, we’ll share two data-driven methods used by some of the most respected figures in the startup world.

According to Eric Ries, growth in startups comes from “engines of growth.” The engines of growth are mechanisms or sources of sustainable, long-term growth.

There are three main engines of growth:

Each engine has a small, specific set of metrics that teams should focus on to determine how fast the startup can grow when using that engine. Tracking these metrics can also help you in determining your product/market fit!

1. The Sticky Engine of Growth

The Sticky Engine of Growth is used by startups that are designed and built to acquire and retain customers for the long term. These startups create a sticky user experience or “lock” customers by making it difficult for them to switch to another vendor.

The metrics to focus on when using this engine of growth are retention rate and rate of compounding.

“The rules that govern the sticky engine of growth are pretty simple: if the rate of new customer acquisition exceeds the churn rate, the product will grow. The speed of growth is determined by what I call the rate of compounding, which is simply the natural growth rate minus the churn rate.”

—Eric Ries

To calculate the rate of compounding, you subtract your growth rate from your churn rate. For example: 7% Growth Rate – 3% Churn rate = 4% rate of compounding.

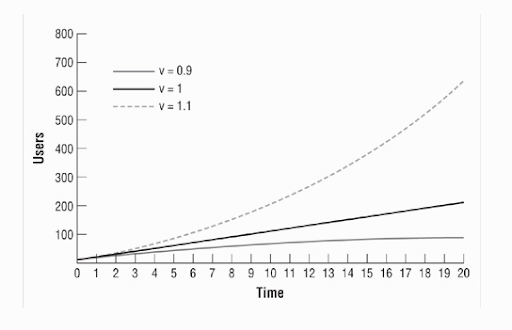

2. The Viral Engine of Growth

Products that grow with this engine rely on a rapid expansion of awareness for the product through viral loops built in the user experience. Growth happens as a side effect of customers using the product.

“Awareness of the product spreads rapidly from person to person, similar to the way a virus becomes an epidemic. This is distinct from the simple word-of-mouth growth discussed above. Instead, products that exhibit viral growth depend on person-to-person transmission as a necessary consequence of normal product use.”

—Eric Ries

The metric to track for the Viral Engine of Growth is the viral coefficient.

Simply put, the viral coefficient is the number of new users an existing user generates.

Let’s say you get 100 new people to sign up for your product:

The chart below illustrates three viral coefficients (0.9, 1, and 1.1) and their long-term growth effect.

To calculate your viral coefficient, use the following formula:

(#) Invitations sent per user X (%) conversion rate = (#) Viral Coefficient

3. The Paid Engine of Growth

Startups that use the Paid Engine of Growth rely on paid advertising or other paid channels to grow.

To calculate how fast the paid engine of growth will turn, companies need to track three metrics:

Use the following formula to calculate Marginal profit:

CLTV – CPA = Marginal profit

Once you establish your primary engine and your desired set of metrics, you can quantify how close you are to product/market fit.

“Since each engine of growth can be defined quantitatively, each has a unique set of metrics that can be used to evaluate whether a startup is on the verge of achieving product/market fit. A startup with a viral coefficient of 0.9 or more is on the verge of success.”

—Eric Ries

When determining your product/market, you want your startup to satisfy the following criteria:

The higher these metrics are, the closer you are to product/market fit and vice-versa.

The product/market fit survey, also known as the ‘Sean Ellis test’ (its creator), has helped unicorns like Dropbox and Eventbrite scale. The primary goal of the survey is to help you understand if your early customers consider your product a must-have.

In 2008, Ellis specialized in helping startups during their growth transition stage. To qualify clients, he conducted a qualitative survey across a sample of the company’s users to evaluate if their product had achieved Product/Market Fit.

“Navigating this important decision around product/market fit is the reason why I created the product/market fit survey 10 years ago. Without the survey, I would either have to rely on gut feeling or wait for retention cohorts to mature to see if we had sufficient customer retention to support sustainable growth. This could delay aggressive growth acceleration execution for several months.”

—Sean Ellis

Today you can access the survey on SurveyMonkey.

The goal of the survey is to get feedback from people who have experienced “real usage” of the product. In other words, customers who have been through your whole lifecycle funnel.

The whole survey contains eight questions, but the critical question is:

“How would you feel if you could no longer use [ProductName]?”

For the survey to be statistically viable, Sean Ellis recommends that you collect a minimum of 30 responses (perfectly 100+). It’s also important that you also limit your sampling size to people who have used your product at least once in the last couple of weeks.

To validate product/market fit, you need to measure the percentage of people who would be “a) Very disappointed” if they could no longer use your product.

If you receive 40% or more respondents answering with “Very disappointed” it’s safe to assume that you’ve reached product/market fit.

Inspired by these kinds of results, Rahul Vohra and the Superhuman team set out to quantify their product/market fit by asking 200 users to complete a four-question poll:

With 22% of respondents answering “A) Very disappointed” to the first question, it was clear that Superhuman had not found product/market fit for their groundbreaking email client. Or at least not yet.

While tools like the Engines of Growth and the Product/market fit survey can help you determine if you’ve reached product/market fit and make the concept less abstract, they don’t help you achieve product/market fit.

“I believe that the life of any startup can be divided into two parts: before product/ market fit (call this “BPMF”) and after product/market fit (“APMF”).” — Marc Andreessen

You’ve poured your whole energy into finding your product/market fit, now what?

Achieving product/market fit is one of the most most important milestones in the life of any early-stage startup. When you reach product/market fit some level of success is almost guaranteed.

But your job is not done yet!

Reaching that step marks the beginning of a new challenge. Now you have to shift your efforts from learning to growth. Product managers should focus on product/market fit, but great product managers think through what would happen if they succeed.

. . .

Productboard is a product management system that enables teams to get the right products to market faster. Built on top of the Product Excellence framework, Productboard serves as the dedicated system of record for product managers and aligns everyone on the right features to build next. Access a free trial of Productboard today.